What is Project Management?

A project can be defined as a series of complex connected activities with a common purpose. It should be unique having one goal and should be completed within a specific time, within a fixed budget and as per the specification.

Table of Content

The above definition itself suggests the meticulousness of activities while performing work under the project management.It requires a team effort. Management of a project needs a strategic planning. There are two levels of strategies namely:

Business level strategy and corporate level strategy. The project management, the business level strategy and corporate level strategy should be aligned properly in order to implement successfully.

Business Level Strategy

Business level strategy deals with how a particular business competes. The principal focus is on meeting competition, protecting market share and earning profit at the business unit level by performing activities differently, offering superior value to customers.

A firm is able to deliver superior value to customers when it is in a position to perform an activity that is distinct or different from that of its competitors.This is popularly defined as competitive advantage. Competitive advantage implies a distinct and sustainable advantage over competitors.

It is a kind of clear superiority or distinctive competence in some functions or area over the competitors. The areas may include finance, marketing, production, human resources, new product development, research etc.

A useful approach to formulating business level strategies is based on Michael Porter‘s competitive analysis‘ and three general alternative business strategies that are derived from it.

Porter’s Competitive Strategies

M E Porter studied a number of business organizations and proposed that business-level strategies are the result of five competitive forces in the company‘s environment.

According to Porter, buyers, product substitutes, suppliers and potential new companies within the industry all contribute to the level of rivalry among industry to be more competitive. Porter suggested three generic strategies that managers might take up to make organizations more competitive.

Cost Leadership

Cost leadership is a strategy that focuses on making an organization more competitive by producing its products more cheaply than competitors can.

The logic behind this strategy is that by producing products more cheaply than competitors, organizations can offer products to customers at lower prices than the competitors and thereby hope to increase market share.

A low-cost strategy is not without risks. To be effective, the company in question should be the cost leader, not just one of several players. Otherwise, two or more companies vying for cost leadership can push prices to unremunerated levels.

Focus

It is a strategy that emphasizes making an organization more competitive by targeting a specific regional market, product line or buyer group. The organization can use either a differentiation or low cost approach, but only for a narrow target market.

The logic of this approach is that an organization that limits its attention to one or a few market segments can serve those segments better than organizations that seek to influence the entire market.

For example, products such as Rolls-Royce automobiles, Titan jewellery watches, Cross pens are designed to appeal to a narrow segment of the market and serve the same well rather than trying to cover the whole ground.

The important risks are possibilities that the costs for the focused firm will become too great relative to those of the less focused one, differentiation too will become less of an advantage as competitors serving broader markets embellish their products, and competitors will begin focusing on a group within the customer population being served by the firm with the focus strategy.

Porter found that many firms did not consciously pursue one of these three strategies and were therefore, struck in the middle of the pack with no strategic advantage. Without a strategic advantage, the business earned below-average profits and therefore, was not in a position to compete successfully.

Porter argued that in the motor vehicle industry, Toyota became the overall cost leader. The company is successful in a number of segments with a full range of cars. Its mission is to remain a low cost producer (like Maruti). In contrast, General Motors also competes in most segments of the market but tries to differentiate each of its products with better styling and innovative features.

Hyundai is successful around the world with four small and medium size cars which it produces at low cost and prices competitively. BMW and Mercedes offer exclusive cars for the price-insensitive, quality-conscious customer.

Porter argued that a company cannot achieve superior profitability if it is struck in the middle‘ with no clear strategy for competitive advantage. Thus, Chrysler came upon hard times because in its Can business it neither stood out as lowest in cost, highest in perceived value, or best in serving some market segment.

Features of Competitive Advantage

Not Sustainable for Long

According to Kotler, competitive advantages are not sustainable, but leverage able. A leverage able advantage is one that a company can use as a spring board to new advantages, much as Microsoft has leveraged its operating system to Microsoft Office and then to networking applications.

Therefore, a company that hopes to endure must be in the business of continuously inventing new advantages.It is not always possible for companies to sustain individual sources of competitive advantage for long (rivals copy and do everything possible to wipe out the edge through their own innovations).

So, the best way to maintain leadership is to continually seek new forms of advantage through constant experimentation, innovative efforts and investments in the latest technology.

Relevant Advantages

In order to implement the chosen strategy, a firm must have the relevant competitive advantage. To become a global player, for example, a cement company can buy or take controlling stakes in competing firms (as in the case of Gujarat Ambuja Cements).

However, unless the company has some relevant competitive edge over its rivals (in terms of pricing, transport costs, distribution network, location of units in cement-deficit states etc.) his acquisition strategy may not pay off in the long run. In the rush to become a major player, a firm, therefore, should not throw caution to the wind and extend its arms over the market beyond a point (remember India Cements case in the Cement Industry.

Backbone of Strategy

A successful strategy is always built around the competitive advantage. Without such a distinct advantage, it is not possible to achieve corporate objectives successfully. It becomes difficult to outwit competitors.

The firm may not be in a position to price its products in a flexible way. Where there is a distinct edge, as in the case of Maruti Udyog Limited (for instance in terms of sales; price advantage, cost advantage owing to its massive scale of operations, monopoly status in the lower income segment etc.), the firm could breathe easily by playing on the price, cost, early bird status, monopoly position, brand image and a host of other factors.

Likewise Bajaj Auto in scooters, Telco in the heavy vehicles segment have acquired competitive advantages by building strong entry barriers (scale of operations, lower costs, etc.).

Acquiring Core Competence

Firms can acquire core competence through heavy investments in technology, research and development followed by new product innovations. Hamel and Prahlad (―Corporate Imagination and Expeditionary Market‖, HBR, July-August 91) argued that most profitable companies are those that create and dominate new markets, looking for opportunities to further explore key skills and competencies.

New product innovations such as chilled prepared meals (Marks and Spencer‘s), the compact disc (Philips) and the anti-lock breaking system for cars (Bosch) took place in companies which have excellent in-house R&D facilities. (In India, Ranbaxy, Dr Reddy Labs in Pharma; TCs and Infosys in Software; HLL, Nestle, Cadbury in fast moving consumer goods have a good track record of exploiting their key research and development skills for achieving consistent growth.

Employees play a key role in acquiring such capabilities. Leaders have to provide a positive work climate for employees to develop such crucial skills. The US Company 3M is renowned for its ability to empower employees and produce innovative products (masking tape, post-in notes etc.); laboratory staff are free to devote 15% of their time on developing ideas. They are allowed to work as per their own convenience. Technicians are encouraged to talk with customers; internal networking is fostered.

Focus on one or two skills

To gain a fundamental, immutable strength in the long-run, a firm should focus on one or two core skills (Michael Porter, Competitive Strategy, New York, Free Press, 1990), which it should develop. Focus does not mean restricting the number of businesses the firm can operate. It only means concentrating on a particular group of customers, a specific geographic area, or a certain part of the product on service line.

The rationale is that by specializing, the organization can serve the market segment more effectively than competitors who try to cover the entire market. The focus strategy still relies on a low-cost or a differentiation approach, or perhaps both, to establish a strong position within the particular market segment or niche. The differentiation within a focus strategy can occur by tailoring products to the exclusive needs of the market segment.

A cost advantage may be simultaneously possible because a firm may be able to offer better prices on custom orders even though another firm may have the cost leadership in serving the larger-volume requirements of broader market. Building core competencies is not easy.

Low Cost Strategies

Low cost leadership strategies are based on a firm‘s ability to offer a product or service at a lower cost than its rivals. When a firm is able to build a substantial cost advantage over other competitors, it can pass on the benefits to customers and gain a large market share.

Low cost woks because after a certain time all markets mature and the number of players and their offerings stagger to a very high level. Buyers in such a market are able to drive down prices to rock bottom levels where only the low cost producers survive (as mentioned in the opening case – this partly explains the success of low cost producers of Ghadi detergent, Anchor toothpaste, Chick Shampoo, Gold winner and Gemini oil brands etc.).

Low cost producers are also able to withstand sluggish demand conditions, weather out business cycles and get ahead of their rivals. Desi brands for example, in FMCG sector are growing at a respectable level even when other established players are finding it difficult to stay afloat (example look at Anchor‘s Growth rate of 50 per cent, Gold winners 24%, Gemini‘s 40%, Ghadi‘s 20% growth rate against HLL‘s flat growth rate in many of its product categories during 2001-03.

Low cost strategies can be used effectively when (a) the market for the product or service is price sensitive (b) the product or service is standardized (c) the buyers re powerful enough to extract a concession from the manufacturer (d) the buyers are not brand-loyal and are willing to switch from one seller to another based on price differences and (e) where differentiation is not possible and even when there is such a possibility – customers do not value it.

A low cost strategy builds competitive advantage through economies of scale, experience curve effects and other factors to capture a substantial share of the market.

Economies of Scale

Large established firms produce, sell and advertise in greater volume than smaller firms and late entrants. The substantial volumes that they are able to generate help them take advantage of economies of scale within many primary and supporting value-adding activities. More employees are required to carry out an activity.

This, in turn, helps them specialize and achieve greater productivity. Fixed costs can be spread over a large volume. The firm can gain from quantity discounts available on components, inputs and other raw materials. Also, large, volume players are in a better position to vertically integrate and make their own inputs at a lower cost.

High levels of vertical integration enable firms to control all of the inputs, supplies, and equipment required to convert raw material into the final end product. At the same time firms could also think of buying more than they make. They can focus effort on these few activities, which they are best equipped to carry on and get supplies from others – thereby avoiding large fixed-cost capital investments.

They can also avoid investing in those technologies or production processes that could become obsolete in a short span of time. For example Dell Computer does not invest in making chips or designing software; it simply assembles and distributes personal computers by buying key components from outside suppliers. The savings obtained through tight inventory and production cost control are passed on to buyers.

Vertical Integration

Extending control over sources of supply (upstream operations) in vertical integration. High levels of vertical integration which can be achieved by fairly large firms help firms control all of the inputs, supplies and equipment required to convert raw materials and equipment into finished products.

Firms pursue vertical integration in cases where their products and technologies tend to remain fairly stable over long periods. Vertical integration could be an important cost driver in cases when the firm manufacturer‘s components that directly feed into its final products.

Differentiation Strategies

The attraction of differentiation over low cost as a basis for competitive advantage is its potential for sustainability. It is susceptible to being overturned by changes in the external environment, and it is more difficult to copy. Differentiation strategies are based on offering buyers something unique or different that makes the firm‘s products or services distinct from that of its rivals.

The important assumption behind differentiation strategies is that customers are ready to pay a premium price for a product that is distinct (or at least perceived as such) in some important way. Like superior quality special appeal, better service etc. According to Michael Porter ―strategy is about selling yourself apart from the competition. It‘s not just a matter of being better at what you do – it‘s a matter of being different at what you do‖.

Differentiation strategies can be pursued by firms when (a) the market is too large to be served by a few firms offering standardized products/services (b) the customer needs and preferences are too diversified to be met through standardized products/services, (c) the firm is able to charge a premium for an advantage that is valued by customers, (d) and the product is such that customer loyalty can be obtained and sustained (e.g. Chicory blended coffee, Darjeeling tea).

Differentiation strategies can be pursued by firms when (a) the market is too large to be served by a few firms offering standardized products/services (b) the customer needs and preferences are too diversified to be met through standardized products/services, (c) the firm is able to charge a premium for an advantage that is valued by customers, (d) and the product is such that customer loyalty can be obtained and sustained (e.g. Chicory blended coffee, Darjeeling tea).

Focus Strategies

Focus strategies aim to sell goods or services to narrow or specific target market, niche or segment. The essence of the focus strategy is the exploitation of a narrow target‘s differences from the balance of the industry. Focus builds competitive advantage through high specialization and concentration of resources in a given niche.

If a niche or segment has distinctive and lasting features, then a firm can develop its own set of entry barriers in much the same way that large established firms do in broader markets. Nowadays, Internet is playing a great role in identifying market segments marked with greater and greater specificity in terms of unique customer needs. Firms can build focus in one of two ways. Focused cost leadership and focused differentiation. Through the cost leadership and the differential focus strategies firms serve the needs of a narrow competitive segment (a buyer group, products segment or geographic location).

This strategy works when firms have the core competencies required to offer value to a narrow competitive segment that exceeds the value available from firms serving customers on an industry-wide basis. By looking into PIMS reports, a company can evaluate the potential effects of various marketing strategies on its performance given the overall features of relevant industries. ―Each business can extract information about the experience of its ―strategic peers‖ (i.e., businesses facing similar strategic positions but possibly in different industries).

Three basic sets of variables have been found to account for 75 to 80 per cent of the variance in profitability and cash flow in the sample of businesses: (1) the competitive position of the business, as measured by market share and relative product quality; (2) the production structure, including investment intensity and productivity of operations; and (3) the relative attractiveness of the server market, comprising the growth rate and customer‘s characteristics‖.

Business Level Strategic Analysis

Business level strategy pertains to each business unit or product line. It focuses on how the business unit competes within its industry for customers.

Strategic choice at the business unit level has to be made taking the industry environment (where the firm has to compete) and the competitive reactions (competitors who have more or less identical products and compete for space) into account.

Apart from focusing attention on these external forces, the firm has to carry out a SWOT analysis to find where it stands, on relative terms, in the industry. Thus, business-level strategic analysis is done through the following:

Industry Analysis

A number of frameworks have been developed for identifying the major strategic alternatives that organizations should consider while choosing their business-level strategies. ME Porter studied a number of firms and proposed that business-level strategies are the result of five competitive forces in the company‘s environment such as potential new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products and rivalry among competitors.

In finding its competitive edge within these five forces, Porter suggested that a firm can adopt one of three strategies: differentiation, cost leadership and focus. A firm that pursues a differentiation strategy seeks to separate itself from the crowd through the quality of its products and services. A firm that follows an overall cost leadership strategy tries to attain a competitive advantage by reducing its costs below the costs of competing firms.

A firm pursuing a focus strategy concentrates on a specific regional market, product line or group of buyers. This strategy may have either a differentiation focus, whereby the firm differentiates its products in the focus market or an overall cost leadership focus whereby the firm manufacturers and sells its product at low cost in the focus market.

Strategic Group Analysis

Within most industries certain business units compete more directly with some businesses than with others. Businesses that engaged in very direct and intense competition with one another are considered to be a strategic group. Most industries contain several strategic groups each of which is composed of members possessing similar strategic profiles. Many firms generally believe that they can win by performing the same activities more effectively than their competitors; but competitors can quickly copy the operationally effective company using benchmarking and other tools, thus diminishing the advantage of operational effectiveness.

For example

In the home loan segment private sector banks, public sector banks and foreign banks like ICICI Bank, Corporation Bank, State Bank, HSBC, City Bank have moved in quickly, copied all that HDFC (the industry leader) has been doing all these years and snatched away a major chunk of market share in recent times. It is worth remembering how Porter defined strategy ―the creation of a unique and valuable position involving a different set of activities‖.

A firm can claim that it has a strategy when it performs different activities from rivals or performs similar activities in different ways‖. Firms like Dell Computers, HDFC Bank, Ranbaxy, Hindustan Inks and Resin.

Asian Paints run their businesses much differently from their competitors, and these competitors would find it hard to copy and synchronise all the different activities that a strategically differentiated firm carries out. Strategic Group Analysis, thus, helps managers develop competitive strategies for their firms within the context of the industry (comparing their own firm‘s strategic postures and actions with their rivals and get ahead of the pack through constant innovations).

Competitor Analysis

Competitor Analysis focuses on each company against whom a form competes directly (Unlike industry analysis and strategic group analysis which focus attention on the industry as a whole or subjects of firms within an industry) within an industry or strategic group. When engaged in a competitor analysis, a firm seeks to understand :

- What drives the competitor, as shown by its future objectives?

- What the competitor is doing and can do? As it revealed by its current strategy.

- What the competitor believes about itself, as shown by its assumptions, and What the competitor‘s capabilities are, as shown by its capabilities?

Life Cycle Analysis

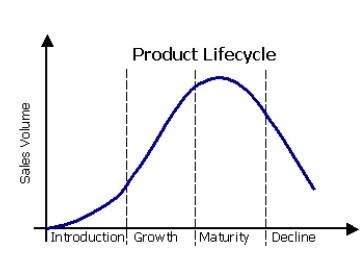

Because economic conditions change and competitive activity varies, firms generally find it necessary to reformulate their strategies several times during a product‘s life cycle. The product life cycle is a conceptual model that indicates that products, markets and businesses evolve through the stages of introduction, growth, maturity and decline. Each stage of the PLC calls for different strategies to be followed at the business unit level (Hofer and Zeithaml.

In the introductory stage, sales will be relatively slow while customers get used to the new ideas introduced by a firm. If the idea clicks, demand may be very high and sometimes outpaces the firm‘s ability to supply the product. At this stage managers need to think about getting the product out of the door without sacrificing quality.

Growth stage is marked by rapid sales growth and increasing profits. Important strategic issues at this stage include ensuring quality and delivery and beginning to differentiate the firm‘s products from competitors‘ products. Entry into the industry during the growth stage may threaten a firm‘s competitive advantage, so, strategies to slow the entry of competitors are important.

At some point, the rate of sales growth will slow and the product will enter a stage of relative maturity. The overall demand growth for a product begins to slow down and the number of new firms producing the product begins to decline.

The number of established firms producing the product may also begin to decline. Product differentiation concerns are still important at this stage, but keeping costs low and beginning the search for new products or services are also important strategic issues. In the decline stage, demand for the product or technology decreases the number of firms producing the product drops, and total sales plunge to low levels.

Sales decline for a variety of reasons such as technological advances, changes in consumer tastes, increased domestic and foreign competition etc. All lead to overcapacity, intense price wars and profit erosion. Organizations that fail to anticipate the decline stage in earlier stages of the life cycle may go out of business. Those that differentiate their product keep their costs lower or develop products or services may do well during this stage.

Experience Curve Analysis

As firms produce, they grow more efficient as experience teaches better ways of doing things. Repetition helps a firm gain mastery over the task, speed up the operations and develop new and improved ways of doing a job at lower cost. Thus, the cost of performing an activity often declines on a per unit basis (known as experience curve effects or economies of experience).

If a firm sells more units than its competition, it should also improve production faster (getting more efficient in terms of unit costs), because it is getting more practice (greater experience).

With lower costs the firm can price more competitively and with lower prices, it can get more customers and increase sales volume, which further reduces costs. Because incumbent firms have more experience than new entrants, their costs will normally be lower.

For instance, any firm trying to enter the integrated-circuit business faces a tremendous challenge to learn how to be cost competitive in a market where experienced players are clearly having a competitive edge – because they are already producing millions of pieces. Experience curve analysis would throw light on the entry barriers already erected by incumbents over a period of time and thus, help new entrants chalk out suitable strategies in line with their capabilities.

SWOT Analysis

SWOT Analysis considers a firm‘s strengths,weaknesses, opportunities and threats. Using SWOT analysis a firm chooses strategies that support its mission and,

(i) exploit its opportunities and strengths,

(ii) neutralize its threats, and

(ii) avoid its weaknesses

Contingency Strategies

Strategic choice is made on the basis of certain assumptions and conditions. If the conditions change drastically, the chosen strategies may have to be discarded altogether. If they are not too radical, the strategies may have to be modified suitable.

But changes do not occur in a sequential order, nor do they give any impending warnings. They surface suddenly leaving deep scars on the faces of managers – if they are unprepared. To be in the safe wide, strategists always keep contingency strategies ready.

Such contingency strategies are formulated in advance to take care of unknown events and unexpected challengers. As rightly summarized by Peter Drucker, successful managers do not wait for future. They make the future through their proactive planning and advanced preparations.

They introduce original action by removing present difficulties, anticipate future problems, change the goals to suit internal and external changes, experiment with creative ideas and take initiative, attempt to shape the future and create a more desirable environment.

FAQ

What is Project Management?

A project can be defined as a series of complex connected activities with a common purpose. It should be unique having one goal and should be completed within a specific time, within a fixed budget and as per the specification.

What is Contingency Strategies

Strategic choice is made on the basis of certain assumptions and conditions. If the conditions change drastically, the chosen strategies may have to be discarded altogether. If they are not too radical, the strategies may have to be modified suitable.