What is market structure?

Market structure can be explained as interconnected characteristics of a market, such as the number and relative strength of buyers and sellers and degree of collusion among them, level and forms of competition, extent of product differentiation and ease of entry into and exit from the market.

Table of Content

- 1 What is market structure?

- 2 Classification of market

- 3 Extent of the Market

- 4 Perfect competition

- 5 Characteristics of Perfect Competition

- 6 Price Determination under Perfect Competition

- 7 Pure and perfect competition

- 8 Perfect Competition in Practice

- 9 Quantity of Production a With Normal Situation of Profit

- 10 Oligopoly

- 11 Duopoly

- 12 FAQ

According to the above explanation, the five elements of market mechanism can be identified as

- Buyers

- Sellers

- Interaction between buyers and sellers

- Existence of a commodity or services to be traded and

- PriceBuyers

- Sellers

- Interaction between buyers and sellers

- Existence of a commodity or services to be traded and

- Price

Classification of market

Markets can be classified on several bases as under

- On the geographical basis i.e. the area of their operations- e.g. local markets, national market and the world market.

- On the functional basis, i.e., the manner in which they function or the business they transact- e.g. mixed or general markets and specialised markets like the produce exchange, stock exchange, money market and foreign exchange market.

- Based on the nature of competition prevailing in the market, we have perfect and imperfect market. Here we are going to learn, classification of market based on competition criterion. Markets are classified based on competition among buyers and sellers.

- Pure Competition: It exists when there are large number of buyers and sellers; the commodity is homogeneous or uniform in quality.

- Perfect Competition: It is a wider concept than that of pure competition. There are large number of buyers and sellers having full knowledge of markets. Either buyers or sellers have no control over the price of a commodity. The price of a commodity is the same all over. There are no transport costs. Factors of production are perfectly mobile. There is free entry of firms. Any firm can leave the industry or any firm can enter the industry. Such perfect markets are rarely found in real life. Therefore, it is said that perfect competition is myth.

- Monopoly: It refers to a market here there is only one producer or only one seller for a commodity. Therefore, he has full control over supply and price.

- Monopsony: When there are large numbers of producers or sellers but there is only one buyer, it is monopsony. A single buyer becomes extra powerful to control the prices.

- Bilateral Monopoly: When there is only one seller and only one buyer, it is a situation of bilateral monopoly. Price in this situation depends upon the relative power of the buyer and seller.

- Duopoly: In this market there are two sellers facing a large number of buyers, producing homogeneous or differentiated products.

- Oligopoly: It is a market form where a few firms control the supply. Each firm will be producing substantial proportion of output in the industry. They produce goods, which may be close substitutes.

Extent of the Market

The extent of the market means the size of the market. This depends upon several considerations.

- Nature of the Commodity: A durable commodity has a wide market, as in the case of gold, silver etc. perishable goods will have limited market.

- Extent of Demand: A commodity, which has universal demand, will have a wider market i.e. silver, gold, etc.

- Portability: When goods are sent from place to place easily, they are called portable goods. The market for such portable goods tends to be wider i.e. Cosmetics, etc.

- Cognoscibility: Certain goods are standardised, can easily be standardised or can easily be classified. If the samples of the commodities can be sent, the customers even from distant places can forward their orders. Such goods will have wider markets.

- Means of Transport and Communications: There are better prospects for expansion of markets because of development of quick means of transport. Similarly, expansion of telephones, mobiles, fax, Internet services increase contact between buyers and sellers resulting in expansion of market for the goods.

- The Level of National Income: The countries having a high level of national income can offer a large market for their products. In this respect, developed countries offer an attractive market for exports.

- Large Population: The countries like India and China have large population. Such countries can offer a side market for a variety of goods.

- Law and order: Good conditions of law and order and political stability are conductive for wider market. Similarly, world peace and security contribute to the expansion of markets.

- Currency and Credit System: A sound currency and credit system helps the expansion of trade and commerce. International Monetary Fund (IMF) plays a great role in the expansion of world trade.

- Trade Policy: Liberal trade policies followed by the countries have the way for international market for the commodities and services. India‘s efforts to adopt liberal trade policy in the recent years have opened her wide market to the other countries. Only large production is not enough. Marketability is very essential to enable them to sell it. All factors affecting the extent of the market must be recognised in the roles of the firm.

Moreover, the nature of the market structure has an important role to play in the determination of output and price. The bargaining power on the part of the seller and buyer depends upon the number of buyers and sellers. The lesser the number on any side, the more the bargaining power.

Perfect competition

Perfect competition refers to the market structure where competition among the sellers and buyers prevails in perfect form. In a perfectly competitive market, a single market price prevails for the commodity, which is determined by the forces of total demand and total supply in the market.

Under perfect competition, every participant (whether a seller or a buyer) is a price taker’. Everyone has to accept the prevailing market price as individually no one is in a position to influence it.

Characteristics of Perfect Competition

The following conditions must exist for a market structure to be perfectly competitive. These are also the distinct features or distinguishing marks of perfect competition:

Large Number of Sellers

A perfectly competitive market structure is formed by a large number of actual and potential firms or sellers. Their number is sufficiently large and as the size of each firm is relatively small, so each one has an in substantial share of the market.

In other words, the individual seller or firm‘s supply is just a fraction of the total market supply. Consequently, any variation in individual supply has a negligible effect on the total supply. Thus, an individual firm cannot exert any influence on the ruling market price.

Large Number of Buyers

There are very large number of actual and potential buyers so that each individual buyer‘s demand constitutes just a fraction of the total market demand. Hence, no individual buyer is in a position to exert his influence on the prevailing price of the product.

From the above two conditions, it follows that though an individual buyer or seller cannot affect the price, all firms together or all buyers together can change the market supply or demand as whole, so that the market price will be affected.

Product Homogeneity

The commodity supplied by each firm in a perfectly competitive market is homogeneous. That means, the product of each seller is virtually standardised i.e. there is no identification of the product of each seller, as there is no product differentiation.

Since each firm produces an identical product, their product can be readily substituted for each other. Hence, the buyer has no specific preference to buy from a particular seller only. His purchase from any particular seller is a matter of chance and not of choice, because of the homogeneity of goods.

Under perfect competition, the market is also described as industry. Industry refers to a set or collection of all the firms or business units producing identical goods. Moreover, because of the homogeneity of product, an individual seller cannot increase its price independently as he might lose all of its market to its competitors.

Free Entry and Exit of Firms

There is free entry of new firms in the market. There is no legal, technological, economic, financial or any other barrier to their entry. Similarly, existing firms are free to quit the market. Thus, the mobility of firms ensures that whenever there is scope in the business, new entry will take place and competition will remain always stiff. Due to the natural stiffness of competition, inefficient firms would have to quit the industry eventually.

Perfect Knowledge of Market Conditions

Perfect competition requires that all the buyers and sellers must possess perfect knowledge about the existing market conditions, especially regarding the market price, quantities and sources of supply.

When there is such perfect knowledge, no buyer could be charged a price different from the market price. Similarly, no seller would unnecessarily lose by selling at a lower price than the prevailing market price. This way, perfect knowledge ensures transactions at a uniform price.

Perfect Mobility of Factors of Production

A necessary assumption of perfect competition is that factors of production are perfectly mobile. Perfect mobility of factors alone can ensure easy entry or exit of firms. Again, it also ensures that the factor costs are the same for all firms.

Government Non-intervention

Perfect competition also implies that there is no government intervention in the working of market economy.

That is to say, there are no tariffs, subsidies, rationing of goods, control on supply of raw materials, licensing policy or other government interference Government non-intervention is essential to permit free entry of firms and for automatic adjustment of demand and supply through the market mechanism.

No Transport Cost Difference

It is essential that competitive position of no firm is adversely affected by transport cost differences. It is thus assumed that there is absence of transport cost as all firms are close to the market or there is equal transport cost faced by all, as all firms are supposed to be equally far away from the market.

Price Determination under Perfect Competition

Price under perfect competition is determined by the forces of demand and supply of the industry. Price once fixed up by the industry is taken up by all the firms and the firm can sell any number of units at that price. The firm may earn normal profits, super normal profits in the short run whereas it earns normal profits in the long run.

- Short Run Equilibrium of a Firm under Perfect Competition Under short period, the firm can face four different situations depending on whether:

Supernormal Equilibrium

Eis the point of stable equilibrium as MC = MR and the MC cuts the MR from below.

This is point the firm produces OM amount of the output. To produce this output, the firm incurs an average cost of MF, while it earns average revenue of ME. It will be noticed that since at equilibrium ME> MF, the firm makes a profit of FE per unit of output sold. Again, since the total revenue earned when OM is sold is OPEM and the total cost incurred to produce the same output is ORFM, the total profit earned at that level of output is RPEF.

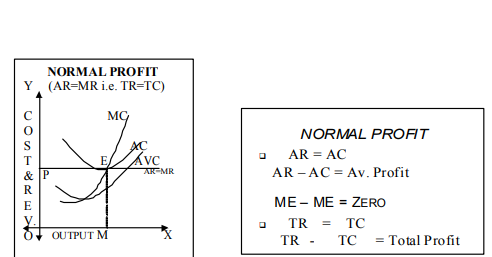

Normal Profits

With the condition of MC = MR and the MC cuts the MR from below, if E is the point of stable equilibrium, output of the firm is OM. To produce this output, the firm incurs an average cost ME, while it earns average revenue, which is also equal to ME. Thus, we see that the firm just makes a normal profit i.e. AR = AC. Since the total revenue earned and the total cost incurred at output OM is OPEM, the firm earns a normal profit.

Losses

At the point of equilibrium i.e. E where MR = MC, the firm produces OM amount of the output. To produce this output, the firm incurs an average cost of PF; while it earns average revenue, which is equal to ME. Since, at equilibrium MF > ME, (AR<AC) the firm incurs a loss of EF per unit of output produced.

Again, since the total revenue earned when OM output is soldis only OPEM, while the total cost incurred at output OM is ORFM, the firm incurs a total loss of PRFE. This is actually the situation where the firm is minimising its losses.

In-spite of incurring loss, the firm could continue its functioning because its average variable cost is being covered. At output OM, the firm covers its AVC, which is equal to MG. Hence, as long as the firm is recovering at least its AVC, it would be possible for this firm to continue functioning.

Shut Down Point

With MR = MC, the firm attains equilibrium at point E where, it produces OM amount of the output. To produce this output, the firm incurs an average cost of MF, whileit earns average revenue ME. At equilibrium MF > ME, the firm incurs a loss of EF per unit of output produced. Since the total revenue earned is only OPEM, while the total cost incurred is ORFM, the firm incurs a total loss of PRFE.

The loss incurred is too much for this firm to continue, as this firms‘ AVC curveis also above its AR = MR curves i.e. it is unable to cover even its AVC. In the above situation, at output OM, the firm‘s AVC, is equal to MG, which is greater than the AR = ME. Hence, this firm is not even recovering its daily or running expenses, so it should shut down.

Long Run Equilibrium of a firm under Perfect Competition

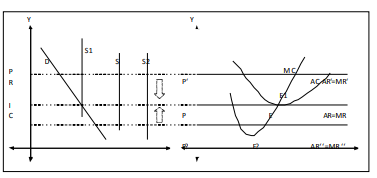

In the long run, due to the assumption of free entry and exit of the firms, it is not possible for the firms to make super-normal profits nor is it possible for them to incur losses. Hence, due to the size of the industry increasing or decreasing in the long run, firms can only earn normal profits in this time period. The possibility of only normal profits can be explained as under.

Suppose that the firm is earning a super-normal profit in the long run, since the industry‘s price (OP) (i.e. the firm‘s AR‘ = MR‘ = OP‘) is greater than its AC. Now, in this situation, new firms would find this area of production to be attractive and hence they would enter this industry in large numbers. With the number of firms increasing, the supply in the industry also rises.

As the supply rises, the price will start lowering. This will go on until the supply curve becomes S1 to S. This leads to fall in price from P1 to P. It will be noticed that the firm‘s AR=MR curve becomes tangential to the firms LAC at point E and so from the situation of earning super-normal profits the profit size has been reduced to normal profit.

Again, suppose that in the firm is incurring losses in the long run since the industry‘s price (OP) (i.e. the firm‘s AR‘‘ = MR‘‘ = OP¡¬) is lower than its AC. Now, in this situation, some of the firms that are unable to recover even their AVC will shut down and leave the industry. With the number of firms decreasing, the supply in the industry also falls. As the supply keeps falling, the price will start rising.

Thus, price rises from P2 to P. This will go on till the supply curve becomes S2 to S. Now it will be noticed that the firm‘s AR=MR curve becomes tangential to the firms LAC and so from the situation of incurring losses, the firm‘s revenues have improved so as to convert losses into normal profits. Hence, we can conclude that in the long run, a firm under perfect competition can only earn normal profits and not earn super-normal profits or incur losses.

Pure and perfect competition

A distinction is often made between pure competition and perfect competition. However, this distinction is more a matter of degree than of kind. For a market to be purely competitive, three fundamental conditions must prevail. These are:

- Large number of buyers and sellers

- Homogeneity of product

- Free entry or exit of firms.

For the market to be perfectly competitive, four additional conditions must be fulfilled viz.

- Perfect knowledge of market

- Perfect mobility of factors of production

- Absolute government non-intervention and

- No transport cost difference.

Incidentally, the term ?perfect competition’ is traditionally used by British economists while discussing price theory. American economists, however, prefer to construct a ‘pure competition’ market model, realistically assuming that additional conditions for perfect competition, such as perfect mobility of labour, perfect knowledge, etc.,may not be attainable.

Perfect competition in fact is just a concept, a suggestive norm or ideal for the market structure. Pure competition substantiates the norm of perfect competition without fully attaining it.

Perfect Competition in Practice

Perfect competition is an ideal concept‘ of market rather than an actual market reality. To some extent, the perfect competition model fits into the market for farm products like rice, cotton, wheat, etc., when all the units of each commodity are identical.

Moreover, oil conditions of perfect competition may not be satisfied. Outside the sphere of agriculture, perfect competition is a rare phenomenon. In fact, in present-day economies, the competitive market is becoming less and less realistic even in agricultural products Market Structure.

Quantity of Production a With Normal Situation of Profit

The diagram is the point of equilibrium of firm because at this point marginal cost and marginal revenue of the firm are equal. At this point, =OQ‘ is the equilibrium quantity, =OA‘ is the price per unit and =OD‘ is the cost per unit. Here, average revenue is slightly more than average cost; in this case, the firm is getting profit equal to the area of =ABCD‘.

In the diagram, = E‘ is the point of equilibrium of firm because at this marginal cost and marginal revenue of the firm are equal. At this point, =OQ‘ is the equilibrium quantity, =OP1is the price per unit and = OP‘ is also the cost per unit. Here, average revenue and average cost are equal. Therefore, the firm is not making any profit or loss.

Loss

In short-run, a firm may have to suffer loss when demand of the product of firm is so weak that the firm has to sell its product at a price less than its cost, hi this case, average revenue of the firm is less than its average cost. It can be illustrated with the help of diagram 3.

In diagram 3.average revenue of the firm is less than its average cost. = E‘ is the point of equilibrium. At this point, = OQ‘ is the equilibrium quantity, = OD‘ is the price per unit and = OA‘ is the cost per unit. Here, price per unit is less than cost per unit. Therefore, the firm is suffering a loss equal to the area of‘ ABCD‘.

Long-term Equilibrium of a Firm

Long-term is the period in which a firm can adjust supply of its product according to its demand. New firms can also enter into the market in the period. Here, a firm always gets normal profit because if a firm is getting abnormal profit in short-term, new firms will enter into the market. It will increase the supply of product and as a result, price of the product will decrease.

This sequence of new firms entering into the market will continue until the firm comes in the position of getting normal profit only. On the contrary, if a firm is suffering loss in short-run, some firms will exit from the industry. Now, supply of the product will decrease and price of the product will increase to the level of average cost or slightly above the average cost. Hence, firm will get normal profit. However, following two conditions should be satisfied for the equilibrium of a firm in the long run.

- Marginal cost and marginal revenue of all the firms should be equal

- Average cost and average revenue of all the firms should be equal. It can be illustrated with the help of diagram.

In diagram, = E‘ is the point of equilibrium. At this point, MC = MR. At this point, = OM‘isthe equilibrium quantity, = OP‘isthe equilibrium price and = QM‘ is the average cost. At this point, average cost and average revenue are equal. It satisfies the conditions of normal profit. In this situation, the firm is getting normal profit equal to the area of PQRS) Market Structure.

Oligopoly

Oligopoly definition

Definitions of Oligopoly

- Mrs. John Robinson – Oligopoly is market situation in between monopoly and perfect competition in which the number of sellers is more than one but is not so large that the market price is not influenced by any one of them”.

- Prof. George J. Stigler – Oligopoly is a market situation in which a firm determines its marketing policies on the basis of expected behaviour of close competitors”. Prof. Stoneur and Prof. Hague – Oligopoly is different from monopoly on one hand in which there is a single seller. On the other hand, it differs from perfect competition and monopolistic competition, in which there is a large number of sellers. In other words, while describing the concept of oligopoly, we include the concept of a small group of firms”.

- Prof. Left Witch- Oligopoly is a market situation in which there is a small number of sellers and the activities of every seller are important for others.

Thus, oligopoly is a market situation in which a few firms producing an identical product or the products which are close substitutes to each other, compete with each other.

Duopoly

According to Dr. John, Duopoly is that situation of a market in which there are two producers of a product, either perfectly identical or almost identical. They are not bound by an agreement regarding price or the quantity of production”.

Duopoly is a market situation in which there are only two producers or sellers of a product who produce and sell almost identical product. However, their pricing policy and marketing policies may be different. They may agree to co- operate with each other or they may go in for cutthroat competition. There may or may not be an agreement between them. They are not bound by an agreement regarding price or the quantity of production”.

FAQ

What is Market Structure?

Market structure can be explained as interconnected characteristics of a market, such as the number and relative strength of buyers and sellers and degree of collusion among them, level and forms of competition, extent of product differentiation and ease of entry into and exit from the market.