What is Rectification of Errors?

The process of correcting the errors committed and to set the accounting records right is called rectification of errors. So accounting errors are the errors committed by persons responsible for recording and maintaining accounts of a business firm in the course of accounting process.

Table of Content

Accounting errors can be classified into two parts, based on whether they affect the trial balance or not.

- Errors which do not affect trial balance

- Errors which affect trial balance

Errors which do not affect trial balance

A trial balance is basically prepared to understand if the records or transactions recorded are arithmetically correct or not. But as discussed above trial balance cannot be considered as a base for the perfect accounting treatment. Even in this scenario errors would have been occurred which, does not affect the trial balance.

These errors are difficult to be detected. These could be caught by comparing the receipts from customer and payments from traders, vouchers of purchase and sales and many other transactions by auditing the accounts.

To mark these errors in the books of accounts, rectified entries are to be passed in the journal proper. The types in this category are:

Error of Omission

This error happens when a transaction is totally absent to be recorded in books or journal or ledger, such an error is known as Error of Omission. In such errors the trial balance gets tally even though the error continues to be, as posting on both debit and credit side is left.

A transaction is totally omitted can be recorded in journal or subsidiary books or ledger in the form of entry. E.g. – Cash sales of Rs 2000 is not recorded. So by writing the correct entry the above error can be rectified.

Cash a/c Dr

To Sales a/c

A transaction is recorded in the journal or subsidiary book or ledger but posting of both accounts has not been done. E.g. – Machinery purchased on credit from Ram Electricals of Rs 50,000 is recorded in journal but their effect in accounts of machinery and Ram electrical has not been given. This could be rectified by debiting the machinery account and crediting ram electrical account in ledger.

Error of Principle

When an error occurs because it’s not according to the accounting principles it is an error of principle. This means that errors do not affect the trial balance because they have been entered in the books of accounts but instead of one account any other account is given the effect.

E.g. – Rs 40,000 worth furniture purchased is debited to purchase account. This entry can be changed by:

Correct entry :

Furniture a/c Dr

To cash a/c

Error committed :

Purchase a/c Dr

To Cash a/c

Entry for rectification :

Furniture a/c Dr

To Purchase a/c

Error of Commission

In this transactions in primary books are recorded not at original amount but either more or less than it. It could also be possible that the entries might be recorded in wrong subsidiary books.

Transaction recorded in correct book by wrong amount. E.g. – Goods of Rs 5000 sold to Anand is recorded as Rs 500. This error will be rectified by :

Error entry :

Anand a/c Dr 500

To Sales a/c 500

Correct entry should have been

Anand a/c Dr 5000

To sales a/c 5000

Rectification done by

Anand a/c Dr 4500

To Sales a/c 4500

Transaction recorded in wrong subsidiary book: E.g. – Goods of Rs 6000 sold to Ankit has been recorded in Purchase book which is a wrong subsidiary book.

Error entry :

Purchase a/c Dr 6000

To Ankit a/c 6000

Correct entry should have been

Ankit a/c Dr 6000

To sales a/c 6000

Rectification done by

Ankit a/c Dr 12000

To Sales a/c 6000

To Purchase a/c 6000

Transaction recorded in wrong subsidiary book with wrong amount. E.g.– Returned goods from Parth of Rs 800 was wrongly recorded in Purchase book as Rs 8000.

Error entry :

Purchase a/c Dr 8000

To Parth a/c 8000

Correct entry should have been

Sales return a/c Dr 800

To Parth a/c 800

Rectification done by

Parth a/c Dr 7200

Sales return a/c 800

To Purchase a/c 8000

Compensatory Errors

When more than one error is committed but their effects are recorded on both the sides (i.e. debit and credit) and the trial balance tallies such are known as compensatory errors.

E.g.– Rs 100 is debited instead of Rs 1000 to Gita’s account and Rs 1000 is credited instead of Rs 100 to Sita’s a/c.

To balance out the correct amount another entry needs to be passed to rectify it and that would be:

Gita’s a/c Dr 900

To Sita’s a/c 900

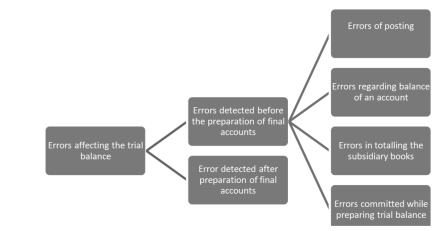

Errors which affect Trial Balance

In certain cases the total of debit and credit balance of trial balance do not match. So it becomes evident that there would have been certain errors committed while making the trial balance, in posting, or recording the amount in writing. Let’s understand the different kinds of errors affecting the trial balance and how they can be rectified.

Errors detected before the preparation of final accounts

Errors of Posting

- Omission of posting in any account: It is a type of omission. In this goods worth Rs 8000 were sold to Akshay. This transaction is correctly recorded in the sales book but the posting in akshay’s account is not done. Credit sales of Akshay is yet not recorded in his ledger, so the error will be rectified by posting the amount on debit side of Akshay’s account.

- Twice posting in an account: In this error the same transaction is posted twice. E.g. Salary paid Rs 30,000 is aptly recorded in cash book but by mistake it has been recorded twice in salary account. Hence it will be rectified by crediting the salary account by the same amount.

- Posting of a wrong account in an account: As the name suggests the entry seems perfect but the amount recorded is wrong. For e.g. – The building is purchased of Rs 50, 00,000 is recorded in building a/c as 5, 00,000. So to balance it out with the correct amount the building a/c is debited with Rs 45, 00,000.

Errors detected after the preparation of final accounts

Normally in the accounting process if the trial balance gets tallied and final accounts are prepared it means no error has been done while recording or posting or at any step. But as seen above if error has occurred before making of final accounts it could be rectified in different ways. Another set of error can occur while making or after the making of final accounts.

So while making trial balance if errors are detected, it can delay the process of making final accounts. In such situations the difference of trial balance in transferred to suspense a/c and later on final accounts are prepared. As explained if trial balance does not get tally the balance is amount is shifted to suspense account as it leads to making of final accounts.

If the difference arises on the debit side of trial balance, it is created as a debit balance in suspense account and shown on the asset side of balance sheet. And if the difference arises on the credit side of trial balance, it is created as a credit balance in suspense account and shown on the capital–liabilities side of balance sheet.

FAQ

What is Rectification of errors?

The process of correcting the errors committed and to set the accounting records right is called rectification of errors.

So accounting errors are the errors committed by persons responsible for recording and maintaining accounts of a business firm in the course of accounting process.